Scan the QR code with your phone to download the app.

Scan the QR code with your phone to download the app.

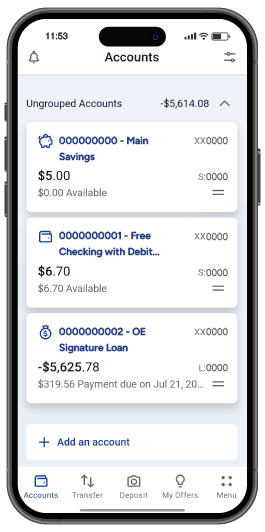

First Service Digital Banking Anywhere You Go

Banking on the go has never been so easy. Take full control over your finances with First Service Digital Banking.

- Quick & Easy Transfers

- Remote Deposits

- Online Loan Applications

- Pay Bills Online

- Debit Rewards

- Account Alerts

Bank Like You Own the Place.

Because you do! When you're a member at First Service, you become part-owner of a thriving community. Let's explore the unique advantages that gives you.

Better Rates. Higher Earnings.

Because we're a not-for-profit credit union, we don't have to pay stockholders or investors. Instead, we invest our earnings in our members by offering you better-than-average rates.

Get Empowered

No matter what stage in life you're in, we've got you covered with articles, tips and financial advice to help you achieve your goals. At First Service Credit Union, we're committed to our members' success. And that success begins with knowledge.